Automate Tax Calculations in NetSuite: Streamline Your Process

Tax season often brings challenges, complex calculations, regulations, and the risk of costly errors. But what if you could simplify the entire process? NetSuite automating your tax calculations can eliminate manual errors, reduce stress, and ensure compliance with the latest regulations. In this article, we’ll explore how leveraging NetSuite’s tax automation features can help you streamline your business’s tax processes.

Why Automate Tax Calculations in NetSuite?

If you’re asking, “Why should I automate tax calculations?”, the answer is clear. Manual tax calculation can lead to mistakes, wasted time, and even compliance issues. Here’s why automation is the key to simplifying your tax process:

Minimized Errors: Human error is inevitable, especially when it comes to tax calculations. Automating this task ensures accuracy every time, reducing the likelihood of mistakes.

Time Savings: Manual tax calculations can be time-consuming and distract your team from other important tasks. Automation allows you to focus on growing your business rather than spending hours on tax computations.

Staying Compliant: Tax laws change frequently. Automated systems ensure that your tax rules stay up to date, so you can remain compliant with local, state, and international regulations.

Key Features of NetSuite for Tax Automation

NetSuite is equipped with a range of features to make tax automation seamless. Here’s a look at some of the highlights:

Built-In Tax Engine: NetSuite offers a built-in tax engine that automatically calculates taxes based on the transaction’s location, product type, and customer details. This eliminates manual input and ensures accuracy.

Third-Party Tax Integrations: For businesses with more complex tax needs, NetSuite integrates seamlessly with third-party solutions like Avalara AvaTax or Vertex. These tools provide real-time tax calculations based on specific jurisdictions, ensuring compliance across various locations.

Customizable Tax Codes: NetSuite allows you to customize tax codes and tax schedules to meet your business’s unique needs. Whether you operate in multiple regions or have different tax rates for different product categories, NetSuite can be tailored to your requirements.

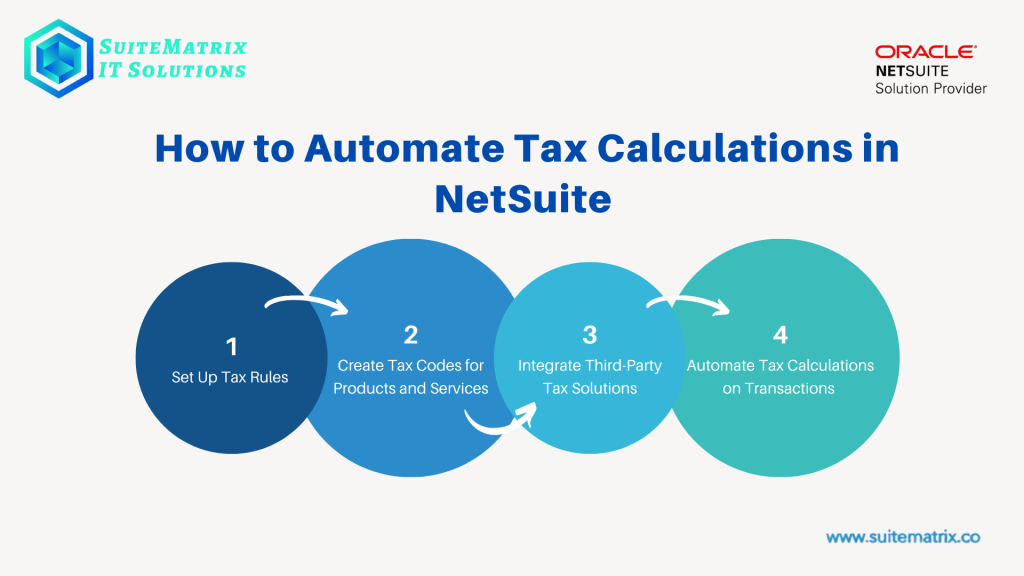

How to Automate Tax Calculations in NetSuite

Ready to automate your tax calculations? Here’s a step-by-step guide to help you get started:

Step 1: Set Up Tax Rules

The first step in automating tax calculations is configuring your tax rules. You’ll need to determine the tax jurisdictions relevant to your sales and business operations. NetSuite enables you to set up tax rates for sales tax, VAT, and more, based on your customer’s location. Additionally, activating Advanced Taxes in NetSuite ensures you meet complex tax requirements for multiple regions.

Step 2: Create Tax Codes for Products and Services

Next, create tax codes to represent the tax rates for different products and services. For instance, you can assign separate tax codes for standard sales tax, VAT, or other special tax categories. This step is essential to ensure accurate calculations for each transaction.

Step 3: Integrate Third-Party Tax Solutions (Optional)

If your tax requirements are more specialized, consider integrating third-party solutions like Avalara AvaTax or Vertex with NetSuite. These services provide up-to-the-minute tax rates based on jurisdiction, ensuring your business stays compliant with the most recent changes in tax laws. Setting up the integration is simple, requiring only a few clicks to install and configure.

Step 4: Automate Tax Calculations on Transactions

Once your tax rules and codes are set up, NetSuite can automatically calculate taxes on all transactions. Here’s how it works:

Items: Each product or service in your inventory should have a tax code attached to it. This ensures that the correct tax is calculated every time an item is sold.

Customers: For each customer, assign the appropriate tax code based on their location and tax exemption status. This ensures that sales tax is applied according to their specific details.

Transactions: When creating sales orders, invoices, or purchase orders, NetSuite automatically applies the correct tax rate based on the items, customer, and location. This takes the guesswork out of tax calculations.

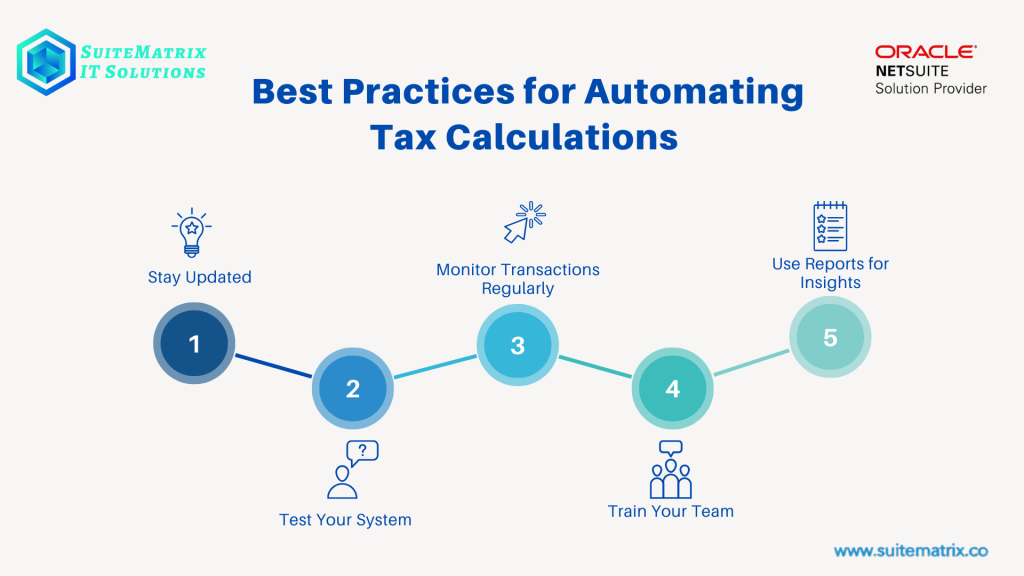

Best Practices for Automating Tax Calculations

To get the most out of NetSuite’s tax automation features, follow these best practices:

-

Stay Updated: Tax laws change regularly, so it’s crucial to keep your tax rules and codes up to date. Schedule regular reviews to ensure compliance with the latest tax laws.

-

Test Your System: Before relying on automated tax calculations for your business, test the system with sample transactions. This ensures that your tax settings are configured correctly and that the right tax rates are applied.

-

Monitor Transactions Regularly: Use NetSuite’s reporting tools to track tax calculations across your transactions. This will help you identify discrepancies early and take corrective action before they escalate.

-

Train Your Team: Ensure that your finance and sales teams are trained on the new tax automation features. The better they understand how the system works, the fewer problems you’ll encounter.

-

Use Reports for Insights: Leverage Saved Searches and other reporting tools in NetSuite to gain visibility into your tax data. This will help you manage your tax obligations more effectively and assist in audits or tax filings.

Conclusion

Automating tax calculations in NetSuite accounting and NetSuite Managed services is an effective way to streamline your business’s tax process, minimize errors, and ensure compliance with evolving regulations. With features like a built-in tax engine, integration with third-party tax solutions, and customizable tax codes, NetSuite offers a comprehensive solution for businesses of all sizes.

By following the simple steps outlined above and adhering to best practices, you can automate your tax calculations in no time. Not only will this save you valuable time, but it will also reduce the risk of costly mistakes and keep your business compliant with tax laws.

Ready to simplify tax season? Start automating your tax calculations in NetSuite today, and watch your business grow with less hassle and more accuracy.